According to one expert, the recent decline in Rivian shares presents a chance for investors.

What took place?

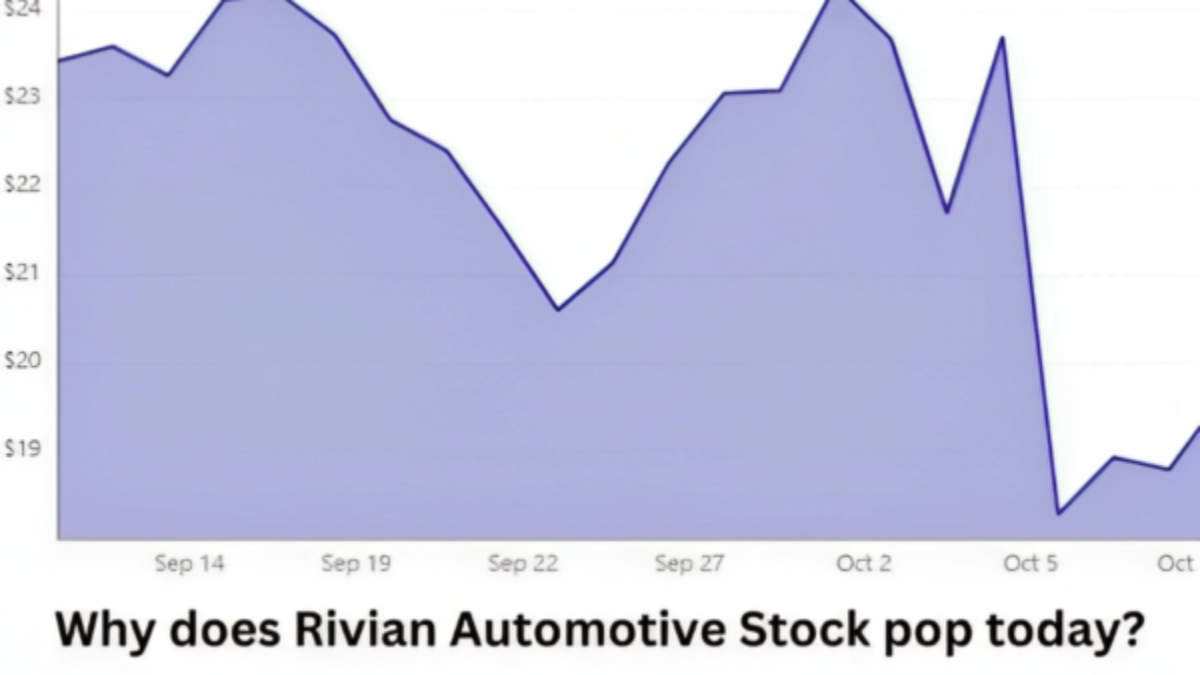

This morning, Rivian Automotive’s (RIVN 4.58%) stock surged, reversing a slide that started last week. The electric vehicle (EV) manufacturer’s stock was up as much as 6.4% before rising 5% about 12:30 p.m. ET.

So what?

Rivian Automotive Stock startled many investors and experts a few days after gratifying investors last week with third-quarter car production and delivery achievements by saying it was financing $1.5 billion in a convertible bond issue.

One of those experts determined today that the stock’s dip following the announcement of that capital raise had provided a great chance to purchase Rivian shares. The firm’s rating on Rivian was raised from a hold recommendation to a buy by UBS analyst Joseph Spak. In addition, he decreased his price objective by $2 to $24 per share. But even so, that would be a 28% increase over yesterday’s closing price.

Now, according to Spak, Rivian Automotive Stock is on track to increase vehicle manufacturing at a faster rate than the business has previously forecast. When it announced its third-quarter results, management reaffirmed that it still plans to build 52,000 EVs this year. Spak, though, believes that the business will outperform that projection and be able to produce 55,000 in 2023.

Even though that would be more than twice what Rivian produced in 2022, it is still below the level of production and sales that would allow the company to become profitable. That would be a step in the right direction for profitability. Additionally, the recently secured additional funds will now support the company’s balance sheet.

The improvement for Spak makes sense. Rivian intends to build a second factory as production and sales increase over the coming years in order to introduce its more affordable car platform. As the second factory gets closer to going into production, the stock price may increase if demand is strong and Rivian performs well.

Should you make a $1,000 investment in Rivian Automotive Stock at this time?

You should know this before you select Rivian Automotive Stock.

Rivian Automotive wasn’t one of the 10 stocks that the Motley Fool Stock Advisor analysis team recently listed as the top stocks for investors to purchase right now.

Since 2002, Stock Advisor has outperformed the stock market by a factor of three. They believe that there are ten equities that are better buys right now.